How to Create a Business Plan for a Small Business (with Example Business Plan Table)

Starting a small business requires more than just passion and an idea. It needs a well-structured business plan to guide you through the critical steps, from defining your objectives to securing funding. A business plan not only helps keep you focused, but it also communicates your vision and strategy to potential investors or lenders. In this blog post, we will walk you through how to create a business plan for a small business, covering essential elements with a sample table for clarity.

Why You Need a Business Plan

A business plan serves several crucial purposes:

Clarity and Focus: It provides a roadmap, keeping your business objectives and strategies in focus.

Funding: Banks, venture capitalists, or even family and friends may require a clear business plan before lending or investing.

Risk Management: A well-thought-out business plan anticipates challenges and sets a proactive strategy to overcome them.

In fact, according to research by Harvard Business Review, entrepreneurs who create formal business plans are 16% more likely to achieve viability than those who do not.

Key Components of a Business Plan

Your business plan should include a combination of strategic, operational, and financial details. Below are the critical sections to include.

1. Executive Summary

The executive summary provides a high-level overview of your business and is often considered the most critical part of the business plan. It should summarize your business idea, mission statement, products or services, target market, and financial highlights. Ideally, this section is written after you complete the entire plan.

2. Company Description

This section gives a deeper look at your business:

Business Name: Include the legal name of your business.

Business Structure: Define whether you're a sole proprietorship, LLC, corporation, etc.

Mission Statement: State the core purpose of your business.

Business Goals: Set out long-term and short-term objectives.

3. Market Analysis

In this section, you provide a detailed analysis of your industry, market trends, and target audience. Include:

Industry Overview: Describe your industry, its growth potential, and market trends.

Target Market: Define your customer segments (e.g., demographics, buying behavior).

Competitive Analysis: Identify your competitors and explain your market positioning.

4. Organization and Management

Provide an overview of your business's organizational structure. If you’re seeking investors, this is where you’ll introduce your management team and advisors:

Organizational Structure: Include an organizational chart.

Ownership Information: Detail the business owners and their percentage of ownership.

Key Management Roles: List leadership positions and key personnel.

5. Products or Services

Describe what your business offers:

Product Details: What are you selling? Include specifics like pricing, lifecycle, and sourcing strategies.

Unique Selling Proposition (USP): Explain what makes your product or service different from your competitors.

6. Marketing and Sales Strategy

Detail your approach to reaching your target market:

Marketing Plan: How will you attract and retain customers? Include your pricing strategy, promotional tactics, and advertising channels.

Sales Strategy: Explain the sales process, from lead generation to conversion. Outline your sales targets.

7. Funding Request

If you’re seeking investment, this section is crucial. Include:

Amount of Funding Needed: How much capital are you seeking? Break down how the funds will be used (e.g., working capital, equipment purchases).

Future Financial Plans: Specify long-term financial goals, such as acquiring additional funds or debt.

8. Financial Projections

This section demonstrates the financial viability of your business. Key elements include:

Income Statements: Projected profit and loss over the next 3–5 years.

Cash Flow Statements: Monthly or quarterly cash flow estimates for the next 3 years.

Balance Sheets: Assets and liabilities at the end of your fiscal year.

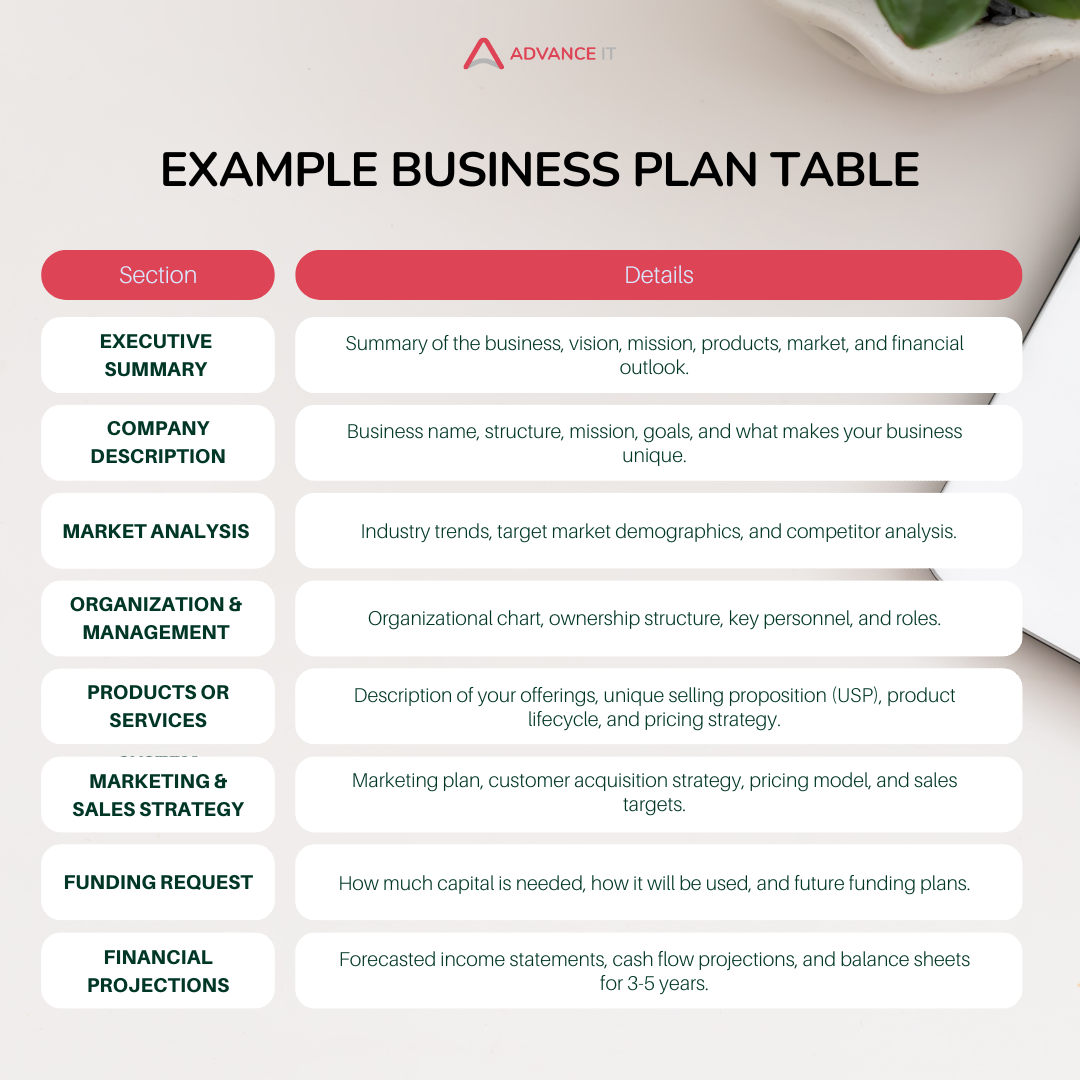

Here's a simple layout of what your business plan might look like. Each section should be as detailed as necessary to cover your business goals.

Example Business Plan Table

Practical Tips for Writing a Business Plan

Keep it concise: Investors and lenders don’t want to read long, drawn-out business plans. Focus on key details and avoid unnecessary jargon.

Use data to back up claims: Support your market analysis and financial projections with real-world data. This will build credibility and show that you’ve done your homework.

Be realistic in financial projections: Overestimating your profits can make you appear less credible. Ground your projections in realistic assumptions based on market research.

The Role of IT in Business Plan Development

While drafting your business plan, it's essential to consider how technology will play a role in your company's growth and operational efficiency. For example, IT solutions for network setup, data management, and cybersecurity could significantly impact your company's long-term success. Including technology services like these in your business plan could help secure funding or investment by demonstrating your commitment to scalability and security.

Installation and Configuration: As your business grows, you’ll need to set up reliable IT infrastructure.

Troubleshooting: Keeping operations smooth is vital, especially as you scale. Plan for IT troubleshooting as part of your risk management.

Upgrades and Maintenance: Highlight the need for periodic IT upgrades to maintain efficiency, which is critical for small businesses to stay competitive.

Conclusion: Business Plan as a Roadmap to Success

A well-crafted business plan is more than just a document to secure funding—it’s a roadmap to guide your small business through growth and challenges. Whether you're just starting or looking to expand, your plan should outline your vision, strategic approach, and financial goals. It should also adapt as your business evolves.

Developing a comprehensive business plan may take time, but it will be a cornerstone of your business’s growth, success, and longevity.